Rise & Fall of Nykaa – Business Case Study & Revenue

Why Nykaa Failed- Case Study and Business Model

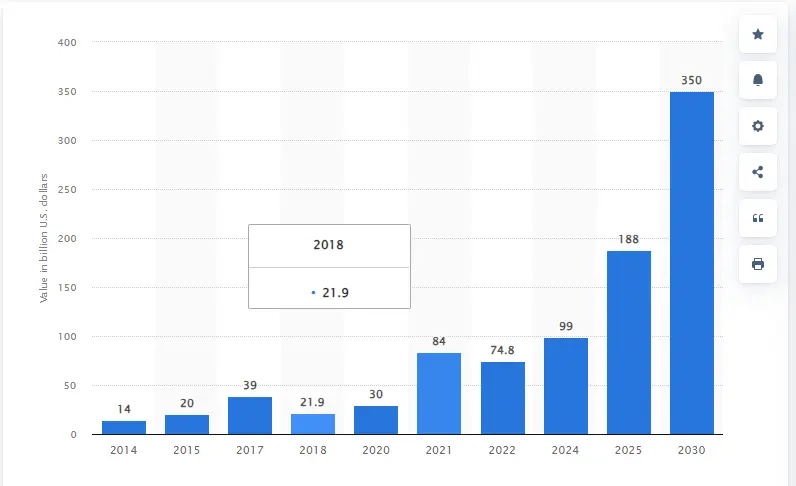

The Indian e-commerce industry is surely a booming industry. This industry is playing a crucial role in the country’s overall development and GDP. According to some reports, India’s social e-commerce has the potential to expand to US$90 billion within Fiscal Year 2025. The reports have also expected that this e-commerce industry in the country is growing at a CAGR of 55-60%.

Similarly, we have Nykaa, which is an Indian e-commerce company that was founded by Falguni Nayar back in 2012. The headquarters of this e-commerce company is present in Mumbai, Maharashtra. We all know what Nykaa is famous for delivering in the Indian market.

Yes, it delivers varieties of cosmetics to Indian customers, targeting women in the country. Now, the cosmetic industry in India is again expected to show strong signs of expansion during the next five years down the line. When Nykaa was launched, there were already lots of buzz in the cosmetic industry to expand in the next ten years down the line.

Moreover, Nykaa is famous for serving great cosmetic products at an affordable price tag to Indian customers. It’s a women-led enterprise and within a few years of its establishment, Nykaa became one of the most famous e-commerce companies in the world. Interestingly, in 2020 Nykaa was listed as a unicorn company and in 2021 it went public.

Further in this article, we will talk about how Nykaa used a business strategy and became famous.

Read More: How Sadhguru Earns Money?

How Does Nykaa Work?

Nykaa offers a long list of well-curated cosmetic-focused products including skincare, haircare, bath, body, fragrance, personal care, and many more. They offer and sell such products from domestic, in-house, luxury, international, and premium brands. The fashion department from Nykaa was launched in 2018 as a curated and managed marketplace. It was curated to make a customer choose the fashion that suits them.

Nykaa fashion house has more than 1500 brands along with 1.8 billion+ products to offer. The fashion house from Nykaa not only offers products to women but, to kids, men, and homes. It has a mixture of domestic, luxury, and premium brand collections.

When it comes to beauty products, Nykaa has built separate business verticals and channels. It is because the customer’s taste and preference to choose their favorite cosmetic is different from choosing any fashion item.

Interestingly, apart from offering a wide range of fashion and cosmetic products, Nykaa has built a good range of content to educate customers related to their products. Now, this is a good initiative taken by the e-commerce company.

Moreover, supplying good and authentic products has always been the key figure for Nykaa. That is how this e-commerce website has positioned itself and gained the trust of Indian customers.

Nykaa Bono Share Strategy

This is also known as Nykaa Bonus Share Strategy. Nykaa raised Rs 20 crore in Series A, Rs 60 crore in Series B, and Rs 100 crore in Series C fundings. Other than these, the company raised hundreds of crores in multiple other rounds thereafter.

Now, as the company grew its valuation automatically grew from Rs 120 crore after Series A, Rs 500.7 crore in Series B, 5713 crore in Series C, and Rs 10140 crore in Series E. This is how Nykaa made its name in the unicorn list.

Interestingly, because of these extraordinary strategies from Nykaa, they did not just become a billion-dollar company but, also became the only profitable unicorn in the Indian market. Now, this is when the company went IPO in the share market.

This is how Nykaa got members like Narottam S, Mala Gopal, and Lighthouse India Fund as their pre-IPO investors. After Nykaa went IPO in the share market, their profits hit 96% which was quite huge. Additionally, because of the negative market sentiment around startups and the fear of recession, the share price of Nykaa dropped more than 40% in the share market from its peak.

This is when the pre-IPO investors of Nykaa wanted to exit Nykaa. But, since they had a one-year lock-in period to be followed they all were waiting for November 10 2022 to sell their shares and earn a good profit out of it. In spite of such low prices, if another huge number of shares flood in the market the share price of Nykaa would surely make a decline.

This is where Nykaa’s team came up with a genius strategy to prevent their stock prices from falling down further. This is where the bonus 5:1 came into existence.

Here, the investors will get five shares of Nykaa. So if you hold one share of Nykaa worth Rs 1200 then it will be split in six parts and you will have six Nykaa shares of Rs 200 each. This proves that the value of the investment remains the same but, the quantity of your share increases by six times. Now, the main question was how the issuing of bonus shares could prevent Nykaa’s share from falling down.

The reason for not falling down its share price goes to Capital Gains Tax. This means nothing but, the tax that you are required to pay on the profits you have made by selling your shares. If you are buying and selling your shares within one year you will incur a short-term capital gain of 15%. If you sell it after one year you will then incur a lot of capital gain tax.

When Nykaa gave out five bonus shares, the cost of these bonus shares is considered to be free and the value of that one particular share can be considered to be dropped. If you want Rs 1200 worth of Nykaa shares and you get a bonus. Now, you have six shares worth Rs 200 each. You would have incurred a loss of Rs 1000 but, if you take the other five shares and their value is 200 rupees each so, you have made a profit on these shares.

Therefore, you are required to pay 15% short-term capital gains tax on this 200 rupees, if you are planning to sell it immediately after the bonus. If you have bought one share of Nykaa during the IPO at Rs 1124, after the bonus issue you get five additional shares for which the cost of acquisition is nil for tax purposes.

If you happen to sell all six shares within the 14th of November at Rs 210 per share then you would incur a loss which would be classified as a long-term capital loss of Rs 915 on that one share that you had bought during IPO.

You are not required to pay tax on that because you bought the share for Rs 1125 during the IPO. Now, for the other five bonus shares your total profit would be Rs 210x5=1050. This is because you effectively bought all the shares for free and they are all worth Rs 210 each. This profit would be classified as short-term capital gains plus 15% tax which is Rs 157.5. This is how Nykaa’s finance team has put a big blockade on their pre-IPO investors and retail investors.

Growth of Nykaa

Nykaa’s share prices could have gone down but, it made a great comeback as well. Within four years down the line Nykaa became one of the leading e-commerce companies in retail beauty. Nykaa currently has 19.4 million active users. Here are some growth results from Nykaa despite falling their share prices:-

- The total GMV of Nykaa increased 47% year on year to Rs 2155.8 in the very first quarter of 2022-23.

- In the very first quarter of FY 23, Nykaa opened up eight new physical stores in the country. The total number of stores opened by this company is 113 in 52 different cities across India.

- The personal and beauty care industry contributed approximately 69% to Nykaa’s total GMV in the first quarter of 2022-23.

- Nykaa’s revenue growth for Q4 FY23 has already reached Rs 13 billion, it is showing a year-on-year growth of 34%.

Nykaa surely did go through a difficult stage during the COVID-19 pandemic. The company experienced a steep fall of up to 70% in its sales on April 2020. But, it seems like the company is gaining on all those incurred losses.